Better.com, also known as Better Mortgage, is an online lender founded in 2016 that provides a completely online mortgage application process. You can find loans, rates, preapprovals and resources 24/7. Better.com offers a mix of mortgage options, such as conventional and jumbo fixed-rate and adjustable-rate mortgages and bridge loans. Additionally, the lender offers rate-and-term and cash-out refinancing and a first-time homebuyer program. You’ll usually be able to secure a preapproval in a matter of minutes and close a mortgage in as few as 21 days.

The loan types offered include:

- Conventional

- Jumbo

- Fixed-rate

- Adjustable-rate

- Rate-and-term and cash-out refinancing

- Bridge loans

The simple process starts online by clicking the “Get Started” button on the Better.com home page and specifying whether you are looking to buy or refinance a home. Clicking the “buying” option prompts a page with various scenarios to choose from to appear. You can then choose from options such as “I’m just researching” and “I’m making offers.” If you choose refinancing, you will state your refinance goal and enter some basic information about the property.

Continuing with the Better.com process can take as little as three minutes, you can receive a basic preapproval, which tells you how much you can borrow or how much you may save with a refinance. Finishing the entire loan application is a “dynamic Q&A” procedure that changes with the data you provide and prompts you for extra information applicable to your situation.

Furthermore, Better.com does not charge any lender payments, including origination, application, processing, or underwriting fees. This means closing prices will likely be cheaper with Better.com than with some competitors. According to their website, most Better.com clients paid between $1,500 – $3,500 in closing expenses last year.

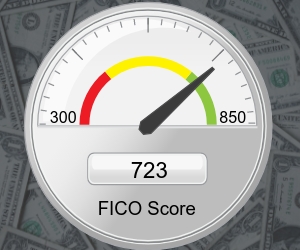

Some lenders permit you to apply with alternative credit data if you either do not have a credit score or have a very poor one. To demonstrate, you could present evidence that you have a history of paying utility bills on time. However, Better.com does not allow alternative credit data. Therefore, Better.com is a better option for borrowers with good credit scores. The minimum credit score requirements depend on which type of mortgage you acquire.

Lastly, the Better Business Bureau (BBB) bestows Better.com an A- rating in trustworthiness. A strong BBB grade shows a company is truthful in its advertising, effective in addressing consumer complaints, and transparent about business practices.