Best Reviews By Consumers

Experian Auto Insurance

Overview

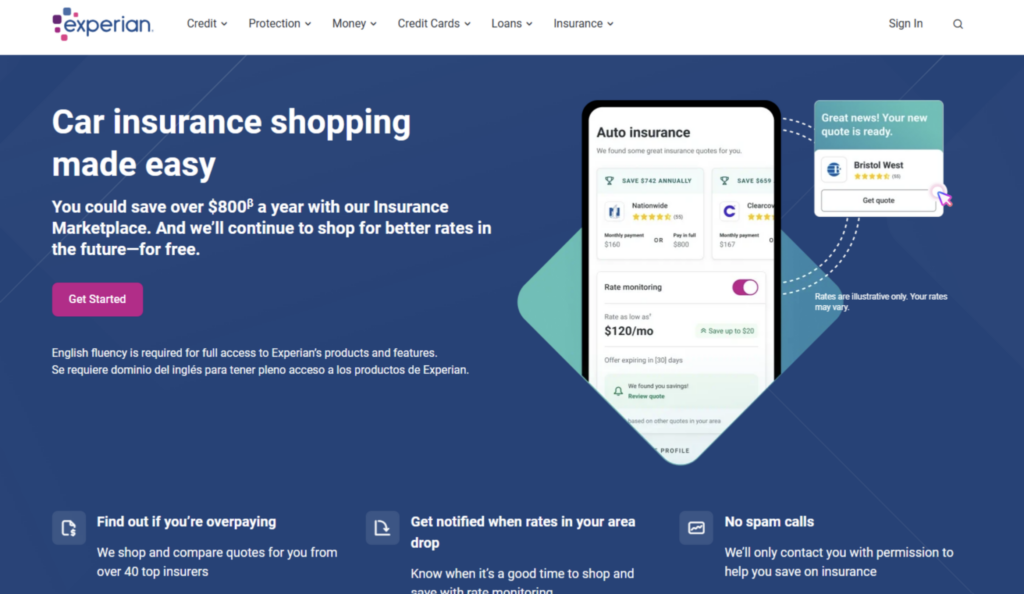

Founded in 1996, Experian is a global leader in credit reporting and financial services. Expanding its offerings beyond credit scores, Experian now provides a comprehensive auto insurance comparison tool. This tool enables users to compare quotes from over 40 major insurance companies, helping them find competitive rates for their car insurance needs.

Experian also offers rate monitoring, alerting users when insurance rates in their area drop, ensuring that they can save money when possible. This service simplifies the process of shopping for insurance, helping users stay informed about the best deals on the market.

Rates from $29/month

Compare Rates in 2 minutes

How Experian’s Auto Insurance Works

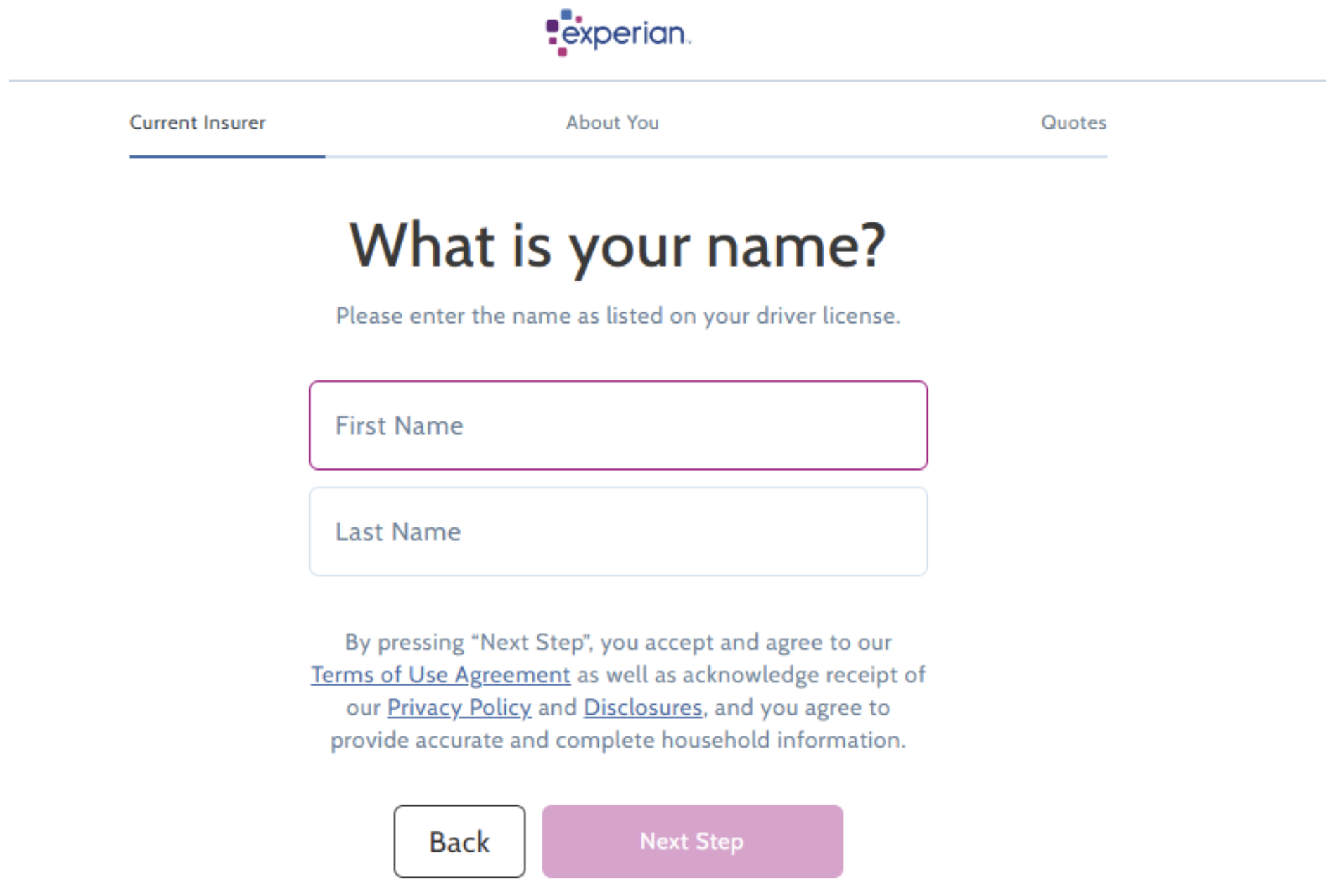

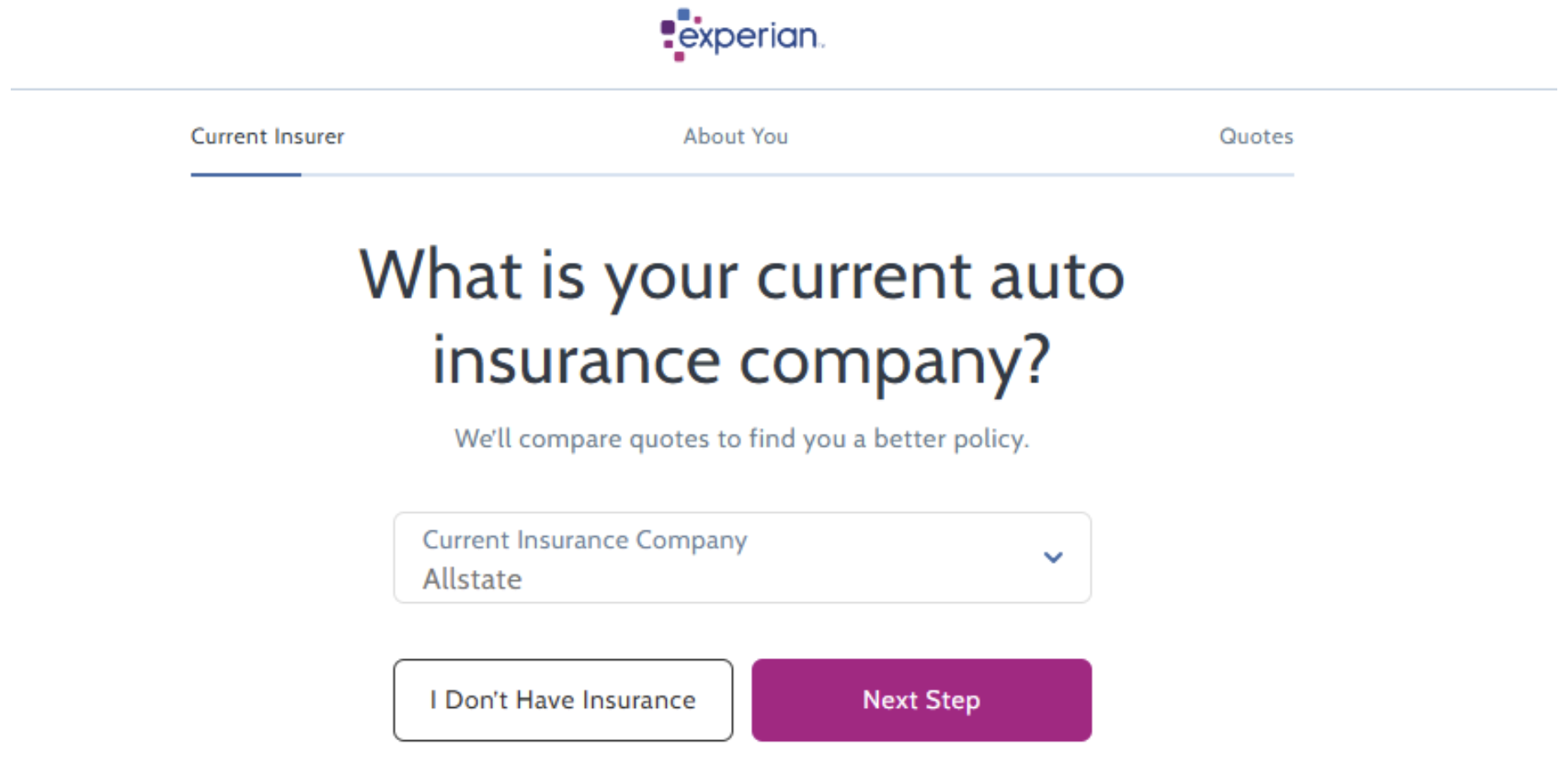

Experian’s process is simple and intuitive. Users enter their information into the platform, and it generates a list of quotes from multiple insurers. Whether you’re an experienced driver or new to insurance shopping, Experian’s platform is designed to be user-friendly.

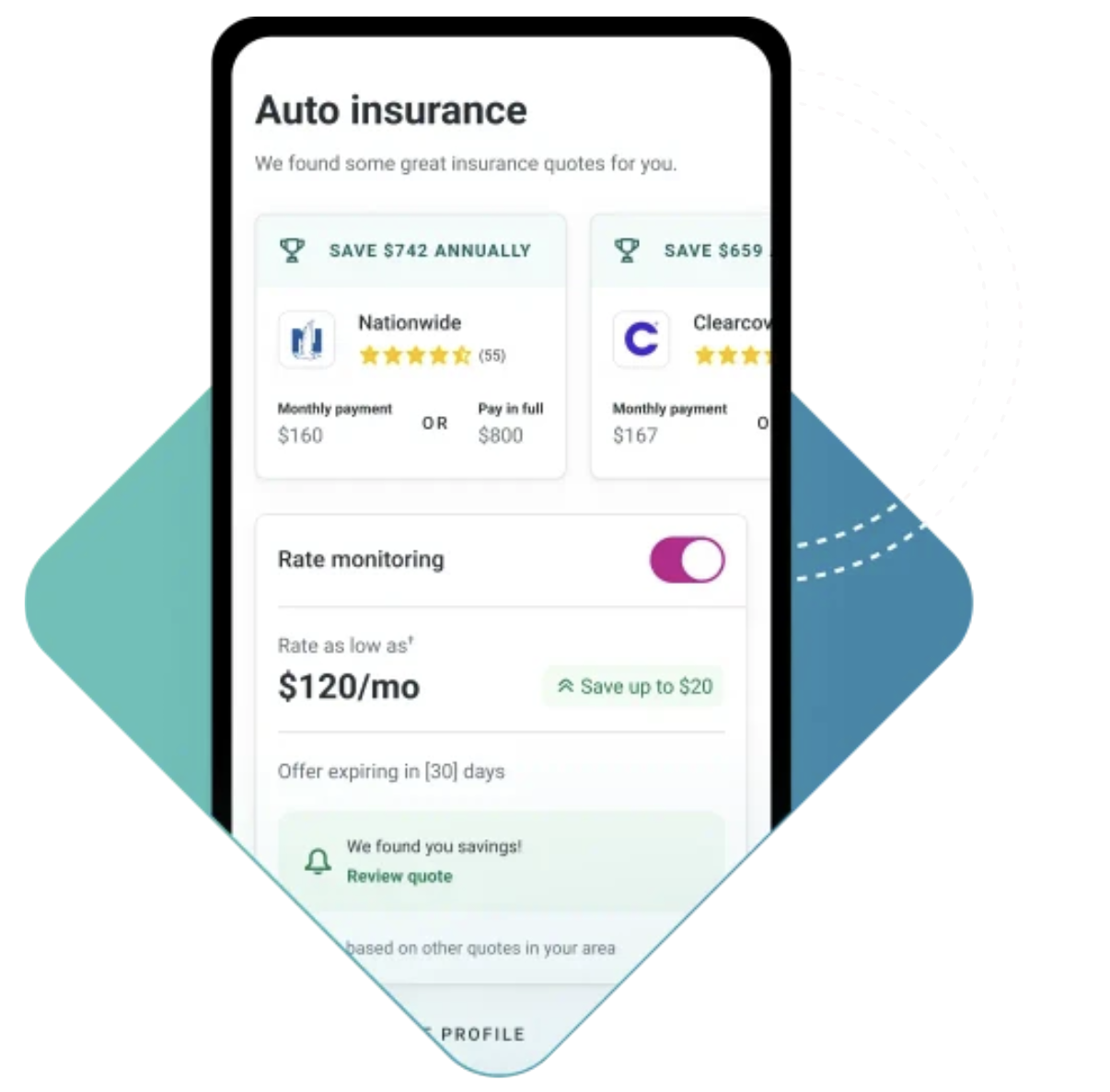

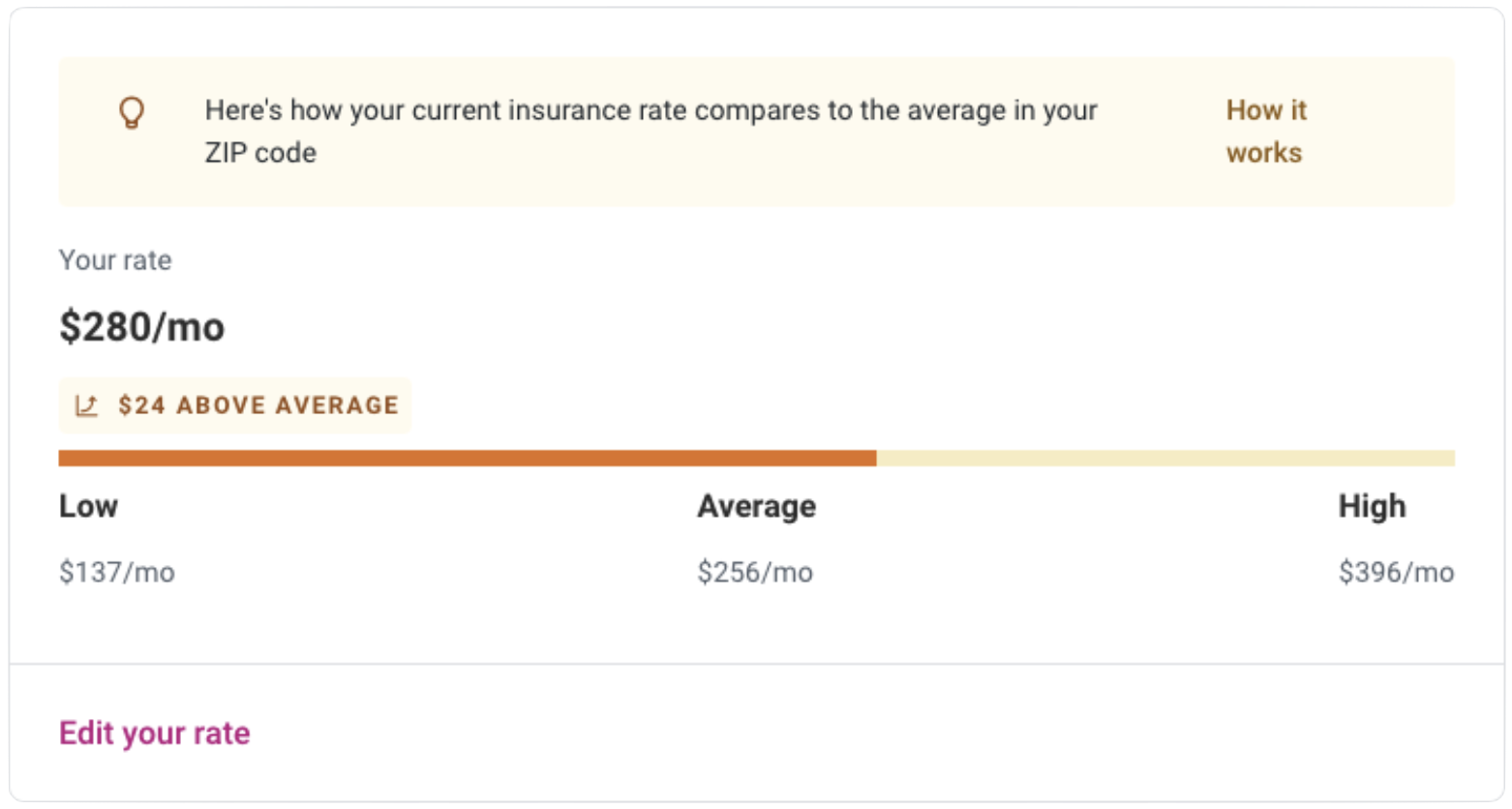

One of the standout features is rate monitoring, which keeps track of your current insurance rate and compares it to the average rates in your area. If rates drop or you could potentially save by switching providers, Experian will notify you. This service is beneficial because it helps users know when it’s a good time to shop for better rates and possibly save money.

For more in-depth monitoring, users can provide additional details about their current coverage, driving history, and vehicle information. If Experian identifies a lower rate than your current premium, it will show you new quotes to consider switching to.

Why Use Experian’s Auto Insurance Comparison Tool?

Insure.com streamlines the insurance shopping experience with a simple, step-by-step process:

- Convenient Comparison: By partnering with over 40 top insurers, Experian offers one-stop shopping for comparing auto insurance quotes, saving time and effort.

- Rate Monitoring: Experian’s rate monitoring service helps users track changes in insurance prices over time and notifies them when it’s the right time to shop around for savings.

- No Spam Calls: Unlike many other comparison tools, Experian only contacts you with your permission. You won’t receive annoying follow-up calls or emails, which is a refreshing change.

- Potential Savings: On average, users who switch and save through Experian save about $828 per year on their auto insurance. This makes it an appealing option for drivers looking to reduce their monthly premiums.

- Privacy and Security: Experian is known for its commitment to consumer privacy. Users can feel confident that their personal information is safe when using the comparison tool.

Pro’s

- Easily compare quotes from over 40 top insurers, giving you a wide range of options to consider

- Receive notifications when rates in your area drop, helping you stay informed and potentially save money

- Only contacted with your permission, ensuring no unwanted follow-up calls or emails

- Customizable monitoring allows you to choose between basic or more detailed options based on your driving profile

- On average, users save $828 per year when they switch, making it a cost-effective tool for finding auto insurance

Con’s

- Some smaller or regional insurers may not be included, limiting the available quotes

- Rates may change after further verification of driving history, credit score, and other factors

- More detailed comparisons require additional personal information, which may take more time

- After receiving quotes, you’ll need to finalize the purchase directly with the insurer, which may involve additional steps

What Makes Experian’s Auto Insurance Different?

Experian stands out due to its focus on rate monitoring. Many comparison tools provide quotes and leave it up to users to check back periodically. With Experian, however, you get proactive alerts when rates drop in your area, making it easier to stay on top of the best offers.

Auto insurance rates from $29/month

Additionally, the service’s transparency ensures that users only receive notifications when it’s necessary, so they don’t deal with spam calls or unwanted solicitations. This user-friendly approach makes it a great option for drivers who want to save money without the hassle of constant marketing.

How to Maximize Your Savings with Experian

To get the most out of Experian’s auto insurance tool, users should take full advantage of the rate monitoring feature. By entering their current rate, users can get ongoing updates about potential savings. Also, it’s helpful to provide as much information as possible for the detailed monitoring feature so that Experian can give more accurate and tailored recommendations.

Additionally, users should take the time to explore all quotes provided and not just focus on the cheapest option. Sometimes a slightly higher premium may offer better coverage, which could save you more in the long run.

Final Thoughts on Experian’s Auto Insurance Comparison Tool

Experian’s auto insurance comparison tool is a convenient and user-friendly service that can help drivers save money and find the right coverage. With features like rate monitoring and a broad range of insurer options, Experian makes shopping for auto insurance easier than ever.

While the service does have a few limitations, such as not including every insurer or requiring some additional details for in-depth monitoring, these are minor drawbacks when weighed against the potential savings and convenience offered.

If you’re looking for a simple way to compare quotes and track changes in rates over time, Experian’s auto insurance tool is an excellent choice for making sure you’re getting the best deal on your car insurance.

Want to get the latest updates? Sign up here!

The most popular articles

The platform is expected to simplify the process for small-business owners and lenders alike. BY...

This week: Apple should improve its Apple Card amid its larger push into financial technology,...

By Jonnelle Marte (Reuters) -The Federal Reserve’s purchases of Treasury securities and mortgage-backed securities are...