Rocket Mortgage is a leading online mortgage lender owned by Quicken Loans, America’s largest mortgage lender. This lender provides a wide range of purchase and refinance loan options. The company has been hailed as the top lender for customer satisfaction for 11 years running by J.D. Power due to their highly rated customer service and smooth online application process. Headquarter in Detroit, Michigan, the lender is licensed in all 50 states and the District of Columbia.

Rocket Mortgage attained prominence through their digitization of the loan application process. The online lender finished the first remote closing in Michigan utilizing Remote Online Notarization (RON) and the Nexsys Clear Sign eClosing platform. Rocket Mortgage’s online-first process makes the application process smooth, whether you log in using RocketMortgage.com or the mobile app.

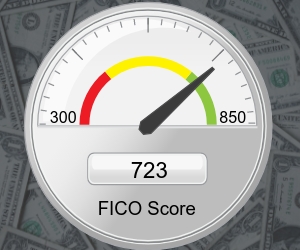

The minimum credit score needed to qualify for Rocket Mortgage is 580. If you qualify, the company will recommend mortgages that could work for your situation and quote rates.

The following information is needed for application:

- An email address for each person who will be on the loan

- Your online banking login

- Your income and employment history

- Your Social Security number

Rocket Mortgage offers the customary menu of loan options, and borrowers can apply for mortgages and lock in rates completely online. Borrowers can easily check their loan application anytime online through the Rocket Mortgage app.

Some loans offered include:

- Conventional fixed-rate mortgages

- Adjustable-rate mortgages (ARMs)

- VA loans

- FHA loans

- Flexible-term

- Jumbo loans

- Cash-out refinancing

- Refinance loans

They also own a flexible-term product known as “YOURgage” which allows borrowers to set their loan terms from 8 to 29 years.