The Chase Freedom Unlimited credit card has been a favorite among cashback fans for a long time now. This card may be appealing for rewards-savvy cardholders looking to get started with the Chase Ultimate Rewards portal.

Chase renewed the Freedom Unlimited card’s rewards system last year to offer bonus cash back on travel purchased through the Ultimate Rewards, as well as on dining and drugstore purchases.

The 1.5% cashback rate on general purchases and perks like travel cancellation/delay insurance and DoorDash DashPass making the card worth holding onto for budding travelers and low-maintenance cashback enthusiasts.

The Chase Freedom credit card gives you 5 options to redeem your rewards. The simplest way is to request cashback in the form of a statement credit or direct deposit, any time and any amount.

You can also use your points to book travel or buy gift cards, but the minimum redemption amount can vary. The final two options redeeming points include using them to shop on Amazon.com or purchasing Apple products through Chase Ultimate Rewards.

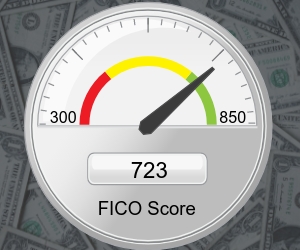

Just keep in mind that you’ll need an excellent credit score to qualify or prequalify for this card. Although the card provides a solid average cashback rate, you’ll get the most value out of your rewards when you pair the Freedom Unlimited with a higher-tier Chase travel credit card.

For a safer and easier checkout, the card has tap technology that allows you to “tap to pay,” as Apple Pay and other mobile wallets offer. Still, Chase Freedom Unlimited isn’t the best choice for everyone. The card may have a high APR, depending on your creditworthiness. If you don’t plan to pay your balance in full each month, you will want to avoid using it.

This card might be a good option for fee-averse consumers who don’t carry a balance to earn rewards for spending in certain categories. But consumers who want a simple rewards program or carry a balance each month should probably explore other options.