Best Reviews By Consumers

Chase Sapphire Preferred

The Chase Sapphire Preferred Card is one of the most popular travel rewards credit card on the market.

100k Points

Bonus offer

$95

Annual fee

24.99%

Cash Advance APR

Great for

Airline, Bonus offers, Rewards, Travel?

Pro

- One of the best bonus rewards credit cards. 2x Ultimate Rewards points on restaurant dining, travel, eligible delivery services, and takeout, plus 1 point per $1 spent on all other purchases and no fee for foreign transactions.

- Generous welcome bonus (valued at $2,000 by TPG) and 25% more value redeeming for airfare, hotels, car rentals, and cruises through Chase Ultimate Rewards®.

Con

- Sapphire Preferred card has an annual fee of $95, which seems pretty high, but if you travel and dine out quite often, you may redeem this money fast.

- No intro APR offer (Standard 15.99%-22.99% Variable) and has a $5 or 5% balance transfer fee of the amount of each transfer, whichever is greater.

Overview

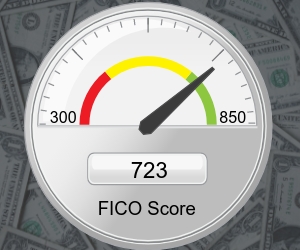

The Chase Sapphire Preferred® Card is a very good credit card for bonus rewards on travel and dining. It is easily worth its $95 annual fee for people with an Excellent or Good credit score (700+) who like to travel, can book at least one trip through Chase, and plan to charge more than $1,333 per month.

To qualify for Sapphire Preferred big initial bonus of 100,000 points, new cardholders have to spend $4,000+ in the first 3 months. That is the centerpiece of this offer, and using the Chase travel portal is required to get top dollar when you redeem. You will get $1,250 in travel booked through Chase or, $1,000 statement credit. Either way, the bonus alone will pay for 10+ years of membership fees.

You can also get a referral bonus for each friend who applies for this card and gets approved. The referral bonus is 15,000 points, and the limit is 75,000 points per calendar year, which means you can get a referral bonus for up to 5 people invited.

The $95 annual fee is low compared to other competing travel credit cards and can easily pay off if you maximize using the card. If you want a luxury travel card with more benefits and don’t mind paying a higher fee, consider the Chase Sapphire Reserve.

This card has been around for over a decade, and it is still considered one of the best rewards credit cards. The Chase Sapphire Preferred® Card doesn’t have fancy travel benefits or luxury lounge access, but it has a great sign-up bonus and earns some valuable points around. It is flexible enough to meet the travel rewards needs of practically every points and miles skill level, and it comes with a low enough price tag for many to be able to give it a try.

Bottom line

Chase Sapphire Preferred credit card is a great place to start if you’re ready to move beyond cash-back or fixed-value travel rewards credit cards. Just because it’s not the flashiest card, but sometimes a solid and adaptable performer is exactly what you need and can make for one of the best credit cards available today.

Want to get the latest updates? Sign up here!

The most popular articles

The platform is expected to simplify the process for small-business owners and lenders alike. BY...

This week: Apple should improve its Apple Card amid its larger push into financial technology,...

By Jonnelle Marte (Reuters) -The Federal Reserve’s purchases of Treasury securities and mortgage-backed securities are...