Best Reviews By Consumers

LendingTree

LendingTree is an online lending marketplace that connects you with an extensive network of lenders that offer diverse loan choices based on your financial situation.

2.81%

30 year fixed

2.30%

15 year fixed

2.71%

5/1 ARM

Loan Types

mortgage, refinance, home equity loans, home equity line of credit?

Pro

- Easy 4-Step Process that finds loan options tailored to individual needs

- Registration and use of service is free

Con

- Due to the high volume of lending partners that LendingTree partners with, you can expect to receive marketing and sales emails and occasionally calls following submission of your contact info

- Not everyone is eligible for LendingTree’s advertised rates

Overview

LendingTree was established in 1966 and is now American’s largest online lending platform with headquarters in Charlotte and North Carolina, and offices in San Francisco, New York City, Chicago, and Seattle. LendingTree has a B rating from the Better Business Bureau and an overall rating of Excellent (81%) from 7,462 reviews on Trustpilot. Hence, LendingTree is a safe and reliable way to efficiently compare lending offers via completion of a simple form.

After filling their information and receiving loan offers, users can compare loans side by side or contact loan providers to negotiate rates. Personal loan amounts vary from $1,000 to $50,000, and certain lenders could potentially fund the loan in as little as 48 hours.

LendingTree matches you with up to 5 loan offers within in a matter of minutes. Its website allows you shop for a wide range of financial services, including those related to:

- Mortgage loans

- Personal loans

- Business loans

- Debt Consolidation

- Student loans

- Auto Loans

- Bank accounts

- Credit Cards

- Credit Repair

After completing a series of brief questions, you are matched with a list of lenders from LendingTree’s database of over 1500 lenders. Typically, you can apply online directly with the lender with links that LendingTree provides.

You can compare refinancing options between lenders and rates available in your area. Financial information like income, debts and assets are required when applying since each lender has different requirements.

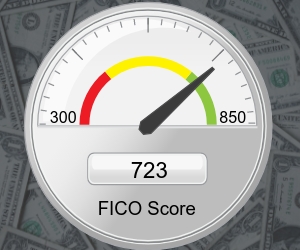

The company also recommends how to improve your credit score and notifies you of loans that can beat your existing rates. Additionally, LendingTree provides different types of loan calculators to help you determine your options for mortgages, such as if you should rent or buy and how to handle other financial situations.

Moreover, you can compare the offers for the following loans:

- Conventional Loans

- Jumbo Loans (Loans exceeding $484,350)

- FHA (Federal Housing Administration) Loans

- VA (Veteran Affairs) Loans

Bottom line

This card is great if you are a frequent traveler, want to travel VIP, or trying to earn many points fast – then American Express Platinum is for you! You can get more than $1,500 worth of value in the first year, so the annual fee of $699 won’t be a huge concern.

Want to get the latest updates? Sign up here!

The most popular articles

The platform is expected to simplify the process for small-business owners and lenders alike. BY...

This week: Apple should improve its Apple Card amid its larger push into financial technology,...

By Jonnelle Marte (Reuters) -The Federal Reserve’s purchases of Treasury securities and mortgage-backed securities are...